The global vanadium ore market is set to experience significant growth in the coming years, with demand increasing due to the metal’s use in steel production and emerging battery technologies.

According to a new market report by The Business Research Company (February 2023), the market is expected to see a compound annual growth rate (CAGR) of 6.1% through to 2027.

The market forecast is less than what The Business Research Company have previously forecasted, even though the market has significantly outperformed their own forecast. With a nearly $400m higher market valuation in 2022 than what was previously projected for 2025.

Key Points:

- The report predicts that the global vanadium ore market will reach $3.76 billion by 2027.

- The increasing adoption of renewable energy sources and energy storage systems is driving the demand for vanadium, which is used to produce Vanadium Redox Flow Batteries (VRFBs), a type of rechargeable battery that stores and releases energy through the flow of vanadium ions.

- Vanadium’s traditional market, high-strength steel, is also set to experience increased demand in the construction and manufacturing industries.

- Vanadium is commonly used as an alloy to improve steel’s strength and durability.

- The Asia-Pacific region is the largest market for vanadium ore, with China and India leading the way due to their steel production and infrastructure development.

- China is the largest consumer of vanadium, accounting for more than 50% of the global demand, followed by the United States and Europe.

- The COVID-19 pandemic had a temporary negative impact on the vanadium market, but the market is expected to recover and grow in the coming years, driven by the increasing demand for vanadium in battery production and other applications.

- Political instability and supply chain disruptions in South Africa, a key producer, could pose challenges to market growth.

- Some of the key players in the global vanadium ore market include Bushveld Minerals, AMG Advanced Metallurgical Group, Largo Resources, Glencore, and EVRAZ.

The growing demand for vanadium in battery production is expected to drive the growth of the vanadium ore market in the coming years.

Vanadium Redox Flow Batteries (VRFBs) are set to become increasingly popular in various applications due to their high efficiency, long lifespan, and scalability.

However, the market was temporarily impacted by the COVID-19 pandemic, but it is expected to recover and grow as the global economy recovers.

With China being the largest consumer of vanadium, it will continue to play a crucial role in shaping the global vanadium market.

Vanadium is a silvery-gray metal that is primarily used as an alloy to enhance the strength and durability of steel. As demand for high-strength steel increases in the construction and manufacturing industries, so does demand for vanadium.

The metal’s ability to reduce the weight of steel structures without compromising strength makes it an attractive option for building lighter, more durable products.

In addition to its use in steel production, vanadium is also gaining attention for its potential as a battery material.

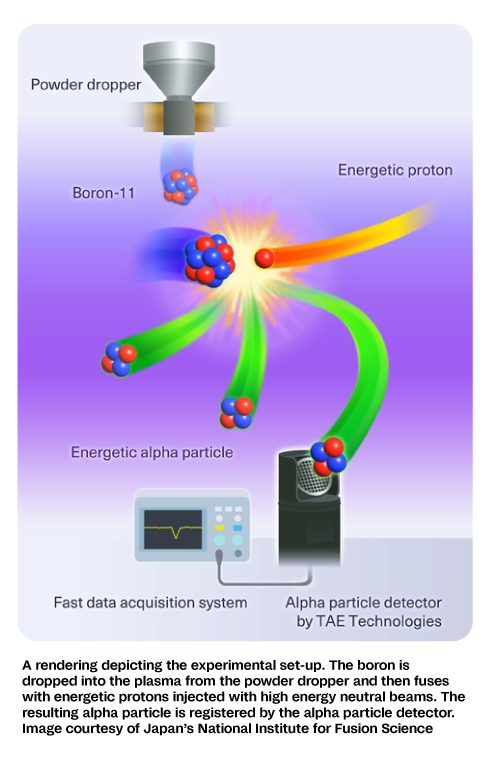

VRFBs, which use vanadium electrolyte to store and release energy, are being developed as a more sustainable and cost-effective option for grid-scale energy storage.

As renewable energy sources like wind and solar become more prevalent, the need for efficient energy storage solutions is growing, and vanadium is poised to play a significant role in meeting that need.

Despite the potential for significant market growth, challenges exist in the vanadium ore market.

South Africa is the world’s largest producer of vanadium, but the country’s political instability and supply chain disruptions have caused concern among market participants.

Other challenges include competition from substitute materials and the high cost of producing and refining vanadium.

Vanadium Ore Types:

Vanadium ore is primarily composed of FeV40, FeV50, FeV60, and FeV80, with FeV80 being the most common ferrovanadium composition.

FeV80 Ferrovanadium Composition

In addition to iron and vanadium, FeV80 contains trace amounts of silicon, aluminium, carbon, sulfur, phosphorus, arsenic, copper, and manganese. Impurities can account for up to 11% of the alloy’s weight.

Traditionally the Vanadium Market have been dominated by steel-industry

Vanadium is a silvery-grey metal that is primarily used as an alloy to enhance the strength and durability of steel. As demand for high-strength steel increases in the construction and manufacturing industries, so does demand for vanadium.

The metal’s ability to reduce the weight of steel structures without compromising strength makes it an attractive option for building lighter, more durable products.

85% of all new cars by 2025 are projected to use vanadium-alloy

As the demand for lightweight and fuel-efficient vehicles rises, the use of vanadium alloys in automobile manufacturing is expected to drive the vanadium ore mining market.

An investing firm, aheadoftheherd.com, predicts that by 2025, approximately 85% of all automobiles will incorporate vanadium alloy to reduce weight and increase fuel efficiency.

Vanadium’s Increasing Role in Energy Storage Spurs Market Growth

Vanadium’s growing use in VRFBs for grid-scale energy storage is a significant driver of market growth. As renewable energy sources become more prevalent, demand for efficient and sustainable energy storage solutions is growing, and vanadium is poised to play a key role in meeting that demand.

Why VRFBs?

The demand for VRFBs is increasing in various applications, including renewable energy integration, grid storage, and backup power systems, due to their high efficiency, long lifespan, and scalability.

In addition to VRFBs, vanadium’s use in aerospace, automotive, and chemical applications is expected to create new opportunities for market growth.

Asia-Pacific Leads the Way in Vanadium Ore Market due to steel-industry

The Asia-Pacific region is the largest market for vanadium ore, with China and India driving demand due to their steel production and infrastructure development. As the region continues to grow and modernize, demand for vanadium is expected to increase.

While the Renewable Energy Market is set to grow demand in North America and Europe

North America and Europe are also expected to see significant growth in vanadium demand due to their increasing focus on renewable energy.

As the demand for renewable energy sources continues to grow, the need for reliable and efficient energy storage solutions becomes increasingly important. Vanadium, with its ability to store energy and release it over a longer period of time, has emerged as a key material for energy storage systems.

VANADIUM ORE MARKETEXCEEDED PREVIOUS TARGETS, YET THE MARKET FORECAST BY THE BUSINESS RESARCH COMPANY REPRESENTS A DOWNGRADE ON THEIR 2021 FORECAST

The Business Research Company released a similarly titled Global Vanadium Ore market report in April 2021 in which they stated:

“The global vanadium ore market is expected to grow from $1.49 billion in 2020 to $1.6 billion in 2021 at a compound annual growth rate (CAGR) of 7.4%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $2.36 billion in 2025 at a CAGR of 10.2%.”

Compared to their most recent report from February 2023 on the same market:

“The global vanadium ore market will grow from $2.78 billion in 2022 to $2.97 billion in 2023 at a compound annual growth rate (CAGR) of 6.9%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, surge in commodity prices, and supply chain disruptions, causing inflation across goods and services effecting many markets across the globe. The vanadium ore market is expected to grow from $3.76 billion in 2027 at a CAGR of 6.1%.”

Thus:

- They predicted the market at $1.6 billion in 2021 at a compound annual growth rate (CAGR) of 7.4%.

- And stated that the Global Vanadium Ore Market sat at $2.78 billion in 2022, a target is well above what they expected for 2025 with a projection of $2.36 billion at a CAGR of 10.2%.

Targets outperformed and 2 Years early suggest the anticipated VRFB structural-shift in the market is in play

We can conclude that the previously anticipated structural market change from being driven by steel-industry to Vanadium Redox Flow Batteries VRFB’s has started to play out.

In 2021 during COVID-19 fear and lowered market projections The Business Research Company said: “The use of vanadium redox flow batteries (VRFB’s) for energy storage is an emerging trend market. This trend will drive a structural change in the vanadium ore mining market dominated by steel manufacturers.”

Steel, saw significantly reduced demand due to construction halts and delays, notably in China with Zero-Covid policy disrupting the economy on a macrolevel.

What remains as the possible cause of the price increase, is the for mentioned predicted market-shift and increased awareness and investment in the VRFB space driving up ore prices.